Bayer’s blockbuster drug Rivaroxaban has seen its share of patent litigations in China, several of which are big enough to be listed as Top 10 IP cases or 50 Representative IP cases. We summarized an invalidation case back in 2020 where all of Bayer’s claims directed towards the compound were upheld. Recently, another Rivaroxaban case made it onto China’s 50 Representative IP cases in 2022, this time in a final judgement from the Supreme Court of an infringement case against a generic company who was marketing the patented drug before the patent expiration date.

At the heart of the case is a dispute over (1) what acts by a generic company are considered “offers to sell” under Chinese patent law and (2) what is the scope of protection provided by the “Bolar exemption” — two pivotal issues that carry significant implications for the pharmaceutical industry.

Decision no. | 〔最高人民法院(2021)最高法知行终451号行政判决书 |

Decision day | August 21, 2020 |

Invention Title | 取代的噁唑烷酮和其在血液凝固领域中的应用 Substituted oxazolidinones and their use in the field of blood coagulation |

Appellant | 南京恒生制药有限公司 Nanjing Hang Seng Pharmaceutical Co., Ltd. (Wholly owned subsidiary: 南京生命能科技发展有限公司 Nanjing Life Energy Technology Develop. Ltd) |

Appellee | 南京市知识产权局 Nanjing Intellectual Property Office |

Patentee | 拜耳知识产权有限责任公司 Bayer Intellectual Property GmbH |

Patent No. | ZL00818966.8 |

Application date | December 11, 2000 |

Earliest Priority Date | December 24, 1999 |

Grant Date | July 05, 2006 |

Rivaroxaban is a widely used anticoagulant drug that treats and prevents various conditions that involve blood clots. It was the first orally available direct factor Xa inhibitor. Since its approval in the US and Europe in 2011, and later in China in 2014, it has achieved a staggering market size of approximately $7 billion USD.

Quick Summary of the Case

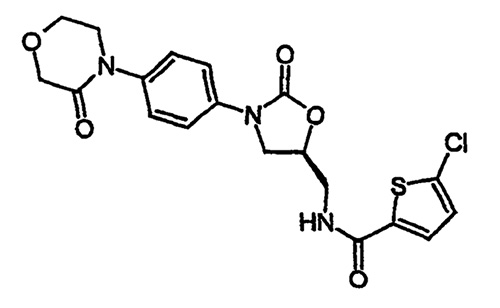

Bayer holds a Chinese patent ZL00818966.8 on substituted oxazolidinones and their use in the field of blood coagulation, which includes the drug product Rivaroxaban. The claims were amended during the invalidation to specifically recite Rivaroxaban, as shown below.

- A compound or pharmaceutically acceptable salt or hydrate thereof, the compound having the structure of the following formula:

In 2018 the generic company (Appellant) Nanjing Hang Seng Pharmaceutical Co., Ltd. (“Hang Seng”) showed a photo of the drug product together with its CAS number on the company’s official website. Nanjing Life Energy Technology Development Co. (“Life Energy”), a wholly-owned subsidiary of Hang Seng printed the product information on promotional materials and both Life Energy and Hangseng’s company names on the business cards. Life Energy also showed promotion information about the drug product on a display board which included Hang Seng and Life Energy’s Trademarks in a Shanghai exhibition of generic manufacturers.

Bayer sued for patent infringement.

Key Issue: were Hang Seng and Life Energy’s actions sufficient to be considered an “offer for sale” of the drug product, and thus patent infringement?

Article 11 of the Chinese Patent Law prohibits the making, using, offering for sale, selling, or importation of a patented invention. However, the interpretation of what constitutes an ‘offer to sell’ can be complex, as highlighted below.

Petitioner Argues there’s No Offer for Sale

Hang Seng argued that there was no actual product available for sale—no pricing or supply volume was provided at an exhibition, and there was no approved financial amount, implying that there was no actual ‘offer to sell’. The argument hinged on the absence of a sellable product, as the promotional materials were not labeled with prices and supply volumes. Hence, such actions only constituted targeted promotion, and thus was evidence against the claim of patent infringement.

The Supreme People’s Court (SPC) disagreed, stating that an ‘offer to sell’ may or may not require a specific target customer. The absence of certain transaction terms—like price or volume—does not preclude the determination of an offer to sell. The SPC pointed to the product information shown in the promotional materials in the exhibition and the company’s website under the “Product Center” section, as clear indications of an offer to sell.

Article 24 of the SPC’s “Several Provisions on Applicable Legal Issues in the Trial of Patent Dispute Cases” clarifies that the “offer for sale” referred to in Articles 11 and 69 of the Patent Law includes advertising, displaying in store windows, and displaying at trade fairs, all of which are considered actions having an express intention to sell goods.

Petitioner Argues Their Actions are Exempt under the Bolar Exemption

China’s version of the Bolar exemption[1] states that those who manufacture, use or import patented drugs or medical devices for the purpose of providing information needed for administrative examination and approval, and those who specially manufacture or import patented drugs or medical devices shall not considered patent infringement.

The petitioner argued that the Bolar Exemption should also be interpreted to include selling and offering to sell. They argued that since their promotions targeted generic drug companies, the Bolar exemption should also apply.

The SPC Decision

The SPC disagreed, stating that the Bolar exemption is strictly limited to two types of entities:(1) those who enforce the patents in order to obtain the information required for administrative approval of generic drugs and medical devices; and (2) those who specifically enforce patents for the aforementioned individuals. Such exceptions do not extend to commercial promotions such as offering to sell, especially for companies like Hang Seng, who could not provide any evidence demonstrating that they could claim to be such type of entity. Therefore, the original judgement was upheld.

EIP Thoughts

This case emphasizes that even preliminary commercial activities, such as advertising or displaying at exhibitions by a generic manufacturer, can constitute an ‘offer to sell’ under the Chinese patent law. There’s no need for the “offers” to be directed towards a specific consumer, nor does there need to be specific information like price, supply volume etc. This is different than in the US, where courts have traditionally interpreted both the “on sale bar” of 35 U.S.C. 102(a)(1) and the “offer to sell” standard for infringement under 35 U.S.C. 154(a)(1) using the standard for a commercial offer for sale under contract law. A valid commercial offer for sale typically requires a description of the product and a price. The definition of an “offer” under Chinese patent law seems to be much, much broader than an offer under normal contract law.

Additionally, this case also clarifies that the Bolar exemption has a narrow application and does not extend to preemptive or promotional marketing activities, which is a very reasonable conclusion.

This case gives drug/medical device innovator companies a very strong tool for monitoring and identifying infringing activity. Of course it can apply to preliminary marketing activities done by generic companies before a patent has expired, but in fact this case really changes the landscape for all innovator companies.

Unlike in the US, where potential infringers may be able to advertise yet keep actual offers and sales private (thus making infringement harder to detect and prove), in China a simple brochure or display, even without a price, is sufficient to be considered infringing activity. This makes identification of infringing activity and subsequent enforcement much, much easier in China.

About Eagle IP

Eagle IP is a top-tier boutique patent firm with a unique mix of experienced US and Chinese patent professionals with significant cross-border knowledge and experience. Our technically expertise covers wide range of technologies including, but not limited, to life sciences, biotechnology, medicine, pharmaceuticals, material and environmental science, chemistry and consumer electronics. We have years of experiences in drafting and prosecuting patent applications involving biological deposits, sequence listings, small and large molecules, drug discovery and development, material science, software and engineering, and many others.

This article is for general informational purposes only and should not be considered legal advice or a legal opinion on a specific set of facts.

-

Article 69.5 of the Chinese Patent Law: the manufacture, use or import of patented drugs or patented medical devices for the purpose of providing information required for administrative approval, as well as the manufacture or import of patented drugs or patented medical devices exclusively for the purpose of such manufacture or import, shall not be regarded as infringement of patent rights. ↑

About the Authors

Pauli Wong is a Principal and Chinese Patent Attorney at Eagle IP, a Boutique Patent Firm with offices in Hong Kong, Shenzhen, and Macau.

Jennifer Che, J.D. is Managing Director and a US Patent Attorney at Eagle IP, a Boutique Patent Firm with offices in Hong Kong, Shenzhen, and Macau.