Update! The finalized Implementation Measures are now out. You can read the details here:

Breaking: China Released New Implementation Measures for the New Patent Linkage System

Last month September 11, 2020, China’s National Medical Products Administration (NMPA) and the China National Intellectual Property Administration (CNIPA) jointly issued a draft set of measures for public opinion about early dispute resolution mechanisms for drug patents, what is referred to as a patent linkage system.

Below is a summary highlighting key provisions.

Creation of an “Orange Book” List

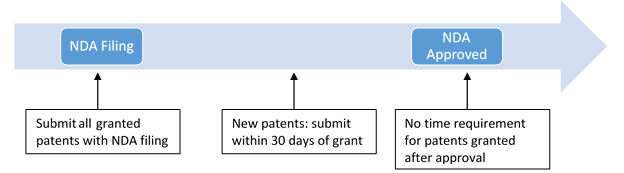

The NMPA will create a public registration platform that will list patent information for all drugs marketed or seeking marketing authority in China (similar to the US “Orange Book”). Drugs must have a new drug application (NDA) on file in China in order to be listed. Patent information includes drug name, patent number, patent type, patent status, patentee, marketing authorization holder, patent expiry date, and contact information. Users will be able to go to the online system themselves and update information as necessary. Applicants and marketing authorization holders are responsible for the accuracy of the information posted.

Deadlines for “Orange Book” List Submissions

Types of Patents that can be Listed

|

Type of Drug |

Listable Patents |

|

Small Molecules |

Compound of API (active pharmaceutical ingredient) |

|

Composition/Formulation of API |

|

|

Medical use of API |

|

|

Biologics |

Sequence structure of the biological product |

|

Traditional Chinese Medicine (TCM) |

Composition having the TCM |

|

Extraction methods of the TCM |

|

|

Medical use of the TCM |

Certifying Patent Status by Generic Drug Applicants

Similar to US requirements under Hatch Waxman, generic drug applicants in China must “certify” the patent status of the innovator drug they are seeking to sell by making one of the below four statements and providing supporting evidence.

As show above, if there is no enforceable patent blocking the generic company, then the application will be approved immediately. However, if there is a granted patent on the list that is still in force, the generic company needs to certify that it believes the patent is invalid or not infringed, almost mirroring the Paragraph IV Certifications under the FDA in the US. Unlike in the US, generic companies in China do not need to notify the innovator. The innovator must monitor the system diligently, and only has 45 days within which to file suit at the People’s Court or oppose with the CNIPA (administrative body). Interestingly, the innovator does need to notify the National Drug Review Institution (NDRI) within 10 days upon receipt of the decision.

In small molecule cases, the NMPA will continue its review but will stay its approval decision for up to 9 months to allow the litigation/opposition to conclude. Once a decision is made, the NMPA will based its decision accordingly on the outcome. If the patent is upheld and infringement would occur, the NMPA will wait until patent expiry to approve the generic. Otherwise, it will approve immediately. See Table 2 for more details.

Table 2

|

Outcome of the People’s Court / CNIPA |

Approval Timeline |

|

Generic drug does NOT fall within the patent |

Normal administrative procedure for review |

|

Parties settle the case |

|

|

Patent is invalidated |

|

|

No decision issued within the 9-month stay period |

|

|

Generic DOES falls within the scope of the patent |

Initial administrative review begins 20 days before the patent expiration date |

The first small molecule generic drug to get approval enjoys its own 12-month exclusivity period (against other generics), which is more generous than the US’s 180-day exclusivity period. This exclusivity period can only last up to the innovator patent’s expiration date.

For biologics and traditional Chinese medicine, the NMPA will not stay approval decisions but will just proceed with the approval process based on recommendations of the NDRI. If a litigation concludes favourably (for the patentee) before the generic approval has been made, the NMPA can still continue the approval process but will indicate that such drug should not enter the market until the listed patent expires.

One area of concern that arises is the tight timelines associated with Category IV declarations. First, the innovator must carefully monitor the platform’s list because, as mentioned above, there is no notification requirement. It is quite possible that an innovator company could completely miss the 45-day window, especially foreign companies who may be a bit more removed. Additionally, foreign clients may need more time to engage proper counsel and manage other aspects of a litigation from afar. A similar provision was added into the newly passed Patent Law but no details regarding the timeline are mentioned.

Second, the rules state that if the People’s Court or the CNIPA has not issued a decision by the 9‑month stay period, the generic market application will be approved. Ideally, it is within the target time line of the court. But in practice, it is difficult to tell at this point whether the Chinese courts and the CNIPA can move through these litigations quickly in order to hand down a decision within the 9-month period. Earlier drafts of this provision provided up to 24 months. Both are in stark contrast to the US, where a 30-month stay is granted. It remains to be seen how this will play out, or whether there will be strong opposition to this section of the draft proposed language. Although it is true that Chinese litigations tend to be much shorter (by law, the time limit to hear first instance civil cases is 6 months), sometimes complex IP cases can still drag on for 1-2 years.

The silver lining in all of this is that, even if the generic drug is approved by the NMPA (and the patent linkage is essentially “broken”), the innovator can still sue the generic company under Chinese Patent Law and may still be able to recover damages, obtain injunctions, etc. However, the NMPA will not withdraw any approvals even if infringement is ultimately found.

When comparing with the US system, there are some key differences that the public could comment on, and possibly still effect change. Clear ones that stand out include the proposal to add a notice requirement for the certification, increase the 45-day period, provide provisions to lengthen the 9-month stay in certain more complex litigations, allow the stay for biologics and Chinese medicine.

The deadline for submitting responses is October 25, 2020.

Related Cases

Breaking: China Released New Implementation Measures for the New Patent Linkage System

Breaking News: China passes Fourth Amendment to the Chinese Patent Law

Diagnostic Claims in China

Polymorph Patents in China: What is the Standard for New Crystal Forms?

About the Authors

Jennifer Che, J.D. is Vice President and Principal at Eagle IP, a Boutique Patent Firm with offices in Hong Kong, Shenzhen, and Macau.

Yolanda Wang is a Principal, Chinese Patent Attorney, and Chinese Patent Litigator at Eagle IP, a Boutique Patent Firm with offices in Hong Kong, Shenzhen, and Macau.

This article is for general informational purposes only and should not be considered legal advice or a legal opinion on a specific set of facts.