China has been implementing a plethora of new laws and measures that are particularly favorable to drug companies, such as patent term extension and patent linkage. Details of the new implementation measures for patent linkage (technically “early dispute resolution mechanisms for drug patents”) came into effect on July 4, 2021. At around the same time, China’s public registration system for innovator companies to list patent associated with marketed drugs (China’s version of the US FDA’s “Orange Book”) began accepting registrations.

It has been close to one year since these mechanisms were put in place. Now, the first legal decisions from these patent challenges are coming out.

China’s Patent Linkage System

China’s patent linkage mechanism is similar to the US version. Generic small molecule drug applicants applying for marketing approval must “certify” the patent status of the marketed drug they are seeking to sell by making one of four statements and providing supporting evidence. The first two statements essentially indicate that there are no active patents that will block the generic drug. The third statement says the generic drug applicant will wait until the listed patent is expired (before marketing its generic drug). Only the fourth statement “[t]he generic drug applicant believes the listed patent should be invalid or not infringed” requires some sort of litigation, such as a patent invalidation or a non-infringement opinion issued by an IP Court or patent office (CNIPA).[1]

As soon as this mechanism became available in 2021, pharmaceutical companies around the world began listing their marketed products on the public registration system. Soon after, generics began to challenge these patents.

Generics Win China’s First Few “Paragraph IV” Litigations

In April 2022, both the IP Court and the CNIPA issued their first decisions from these generic patent challenges. We briefly summarize the two cases below:

IP Court Rules Against Roche Chugai Pharma

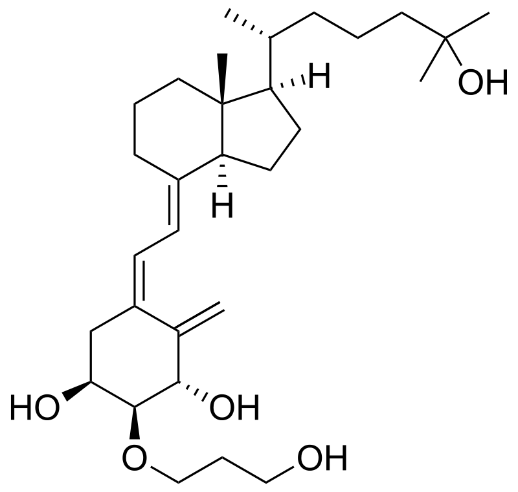

On April 15, 2022 the IP Court issued its first patent linkage “Paragraph IV” ruling. Chinese generic drug manufacturer Wenzhou Haihe Pharmaceutical Industry requested the IP Court to declare that its generic product did not fall within the scope of Roche Chugai Pharmaceutical’s patent claims covering Eldecalcitol, a drug for osteoporosis.

Below is claim 1 of the granted patent:

CN1938034B

1. A composition comprising:

(1) (5Z, 7E)-(1R, 2R, 3R)-2-(3-hydroxyl propoxyl)-9,10-secocholesta-5,7,10 (19)-triolefins-1,3,25-triol;

(2) lipids; and

(3) an antioxidant;

wherein, the antioxidant is added to prevent

(5Z, 7E)-(1R, 2R, 3R)-2-(3-hydroxyl propoxy)-9,10-cholesterol-5,7,10 (19)-triolefins-1,3, 25-triol

from being degraded to

6E-(1R, 2R, 3R)-2-(3-hydroxyl propoxy)-9,10-cholesterol-5 (10), 6,8 (9)-triolefins-1,3, 25-triol

and/or

(5E, 7E)-(1R, 2R, 3R)-2-(3-hydroxyl propoxy)-9,10-cholesterol-5,7,10 (19)-triolefins-1,3, 25-triol;

wherein after 12 months, the amount of

6E-(1R, 2R, 3R)-2-(3-hydroxyl propoxy)-9,10-cholesterol-5 (10), 6,8 (9)-triolefins-1,3, 25-triol

and/or

(5E, 7E)-(1R, 2R, 3R)-2-(3-hydroxyl propoxy)-9,10-cholesterol-5,7,10 (19)-triolefins-1,3, 25-triol

is 1% or less.

The IP Court ruled that the generic applicant’s drug did not fall within the scope of Roche’s patents. We do not have details of the case, but presumably Wenzhou Haihe was able to demonstrate that their product did not infringe because it did not have the exact ingredients resulting in the specific claimed degradation percentages.

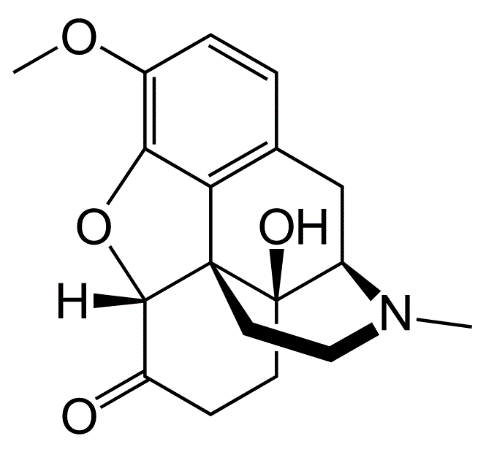

CNIPA Rules Against Purdue Pharma

Ten days later (April 25, 2022), the first CNIPA patent linkage ruling came out. Though the decision came out slightly later, it was much faster. In fact, it only took the CNIPA 6 months to complete the administrative procedure, compared to the IP Court litigation, which took about 8 months. Some have even described this as a competition between the Court and the Patent Office.

This CNIPA case involved three patents by Purdue Pharma covering sustained release tablets of oxycodone hydrochloride. The CNIPA ruled that the product by the generic applicant (Yichang Humanwell Pharmaceutical Co., Ltd) did not infringe all three Purdue Pharma’s patents because it did not fall within the scope of the claims.

Below are some example independent claims from the aforementioned three patents. As you can see, these are all very, very narrow formulation patents that the generic drug could presumably easily design around.

CN105267170B

1. a composition comprising

(1) at least one polyethylene oxide having a molecular weight of at least 800,000 based on rheological measurements; and

(2) at least one active agent selected from opioid analgesics;

wherein said composition comprises at least 80 wt% of the at least one polyethylene oxide having a molecular weight of at least 800,000 based on rheological measurements.

CN101812065B

1. A solid oral extended-release pharmaceutical dosage form comprising an extended-release matrix formulation, said extended-release matrix formulation comprising an oxycodone hydrochloride composition containing an amount of less than 25 ppm level of 14-hydroxycodeine ketone.

10. A pharmaceutical dosage form comprising a combination of oxycodone hydrochloride having a level of 14-hydrocodeinone of less than 25 ppm, further comprising a conventional excipient extended release oral dosage form comprising granules, said granules comprising 10 mg to 320 mg of oxycodone hydrochloride comprising less than 25 ppm levels of 14-hydroxycodeine ketone, said granules being coated with a material allowing hydrocodone hydrochloride to be released in an aqueous medium at a sustained rate.

30. A packaged oxycodone hydrochloride composition comprising at least 1 kg of an amount containing less than 25 ppm as defined in any one of claims 1-9, oxycodone hydrochloride composition containing less than 25 ppm level of 14-hydroxycodeinone as defined in claim 1-9 or the pharmaceutical formulation as defined in claims 10-29.

31. A pharmaceutically acceptable package of a pharmaceutical dosage form as defined in any one of claims 10-29.

CN102657630B

1. A solid oral extended-release pharmaceutical dosage form comprising an extended-release matrix formulation, said extended-release matrix formulation comprising

(1) at least one polyethylene oxide having an approximate molecular weight of at least 1,000,000 based on rheological measurements; and

(2) at least one active agent selected from opioid analgesics, wherein said opioid analgesic is oxycodone hydrochloride, and

wherein said dosage form comprises from 5 mg to 20 mg of oxycodone hydrochloride, and

wherein said composition comprises at least 80 wt% of an approximate molecular weight, based on rheological measurements, of at least 1,000,000 of polyethylene oxide.

Initial Comments:

In all four cases above, the patents relate to very narrowly drafted dosage forms or formulations, not composition of matter claims on active ingredients. As such, it was likely much easier for the generics to designed around such claims by using a slightly different formulation.

It’s interesting to note that the first generic to successfully challenge a patent under the patent linkage provisions will receive market exclusivity for 12 months. As such, these first few “wins” are quite valuable to the Chinese generic companies who received them.

Furthermore, although the IP Court was “slower” than CNIPA in issuing a decision, 8 months is still pretty fast, and well within the typical timeframes for civil litigations in China. Therefore, regardless of whether CNIPA or IP Court is used, these first few cases demonstrate that the entire process can finish within the 9-month stay period. Let’s hope that future cases continue moving at this pace.

Since the October 2021, the CNIPA has received 59 applications under the patent linkage system, and accepted 36 of them. Compared with the court system, the patent office’s document requirements are generally “friendlier”. As such, we think more applicants will choose the faster and easier administrative route in the coming future.

All in all, we are in exciting times as China is quickly laying down the groundwork for its own patent linkage path. We look forward to learning more as additional decisions come down the line.

- For more details, read our post about China’s patent linkage system ↑

About the Authors

Jennifer Che, J.D. is Vice President and Principal at Eagle IP, a Boutique Patent Firm with offices in Hong Kong, Shenzhen, and Macau.

Yolanda Wang is a Principal, Chinese Patent Attorney, and Chinese Patent Litigator at Eagle IP, a Boutique Patent Firm with offices in Hong Kong, Shenzhen, and Macau.

This article is for general informational purposes only and should not be considered legal advice or a legal opinion on a specific set of facts.